Having the discipline to Save money can be a hard task for some people, but with the introduction of technology, daily money savings apps have made it easier for most Nigerians to save regularly.

These apps offer a range of features that promote financial discipline and make saving money a seamless experience.

So, In this article i want to explore what I believe are the Top 10 best daily money savings apps in Nigeria at the moment, these apps offer Alot of amazing features to Thier Customers

Top 10 Daily Money Savings Apps

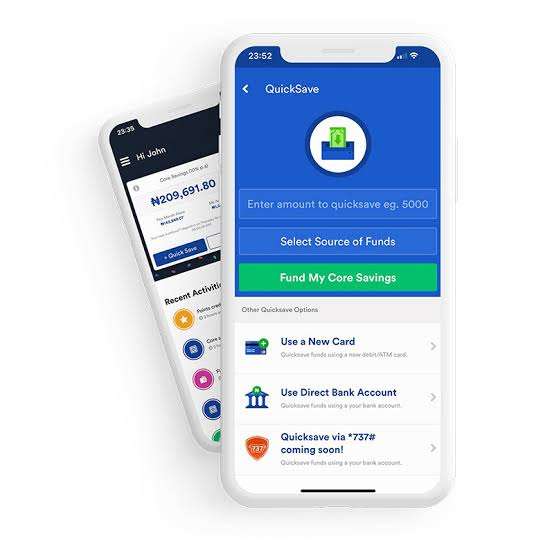

1. Piggyvest

Piggyvest is one of the most popular daily money savings apps in Nigeria. It offers a user-friendly interface and a variety of saving options to help users save money efficiently.

Features:

- Automated Savings: Set up automatic savings plans for daily, weekly, or monthly contributions.

- Safelock: Lock funds away for a fixed period to earn higher interest rates.

- Target Savings: Create specific savings goals and track your progress.

- Flex Dollar: Save and earn in dollars, offering an opportunity for currency diversification.

- Investify: Access investment opportunities with returns up to 25% per annum.

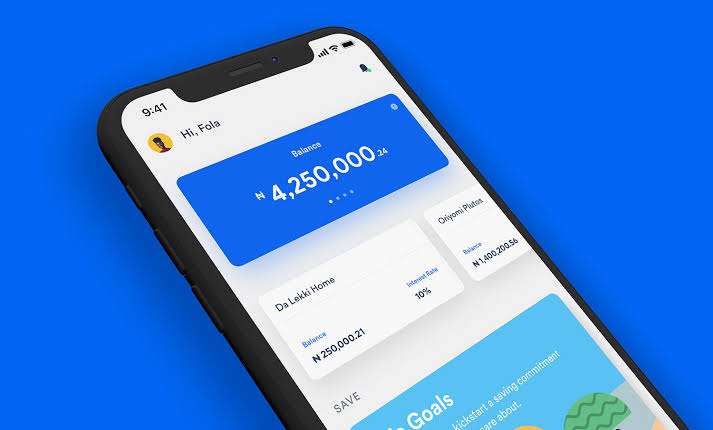

2. Cowrywise

Cowrywise is another excellent daily money savings app that provides a comprehensive suite of financial planning tools and investment options.

Features:

- Automated Savings Plans: Create automated saving schedules for consistent savings.

- Savings Circles: Save together with friends and family to encourage group savings.

- Investment Plans: Choose from various investment plans with attractive returns.

- Goal-Based Savings: Set and track different savings goals.

- Education Savings: Plans specifically designed to save for educational expenses.

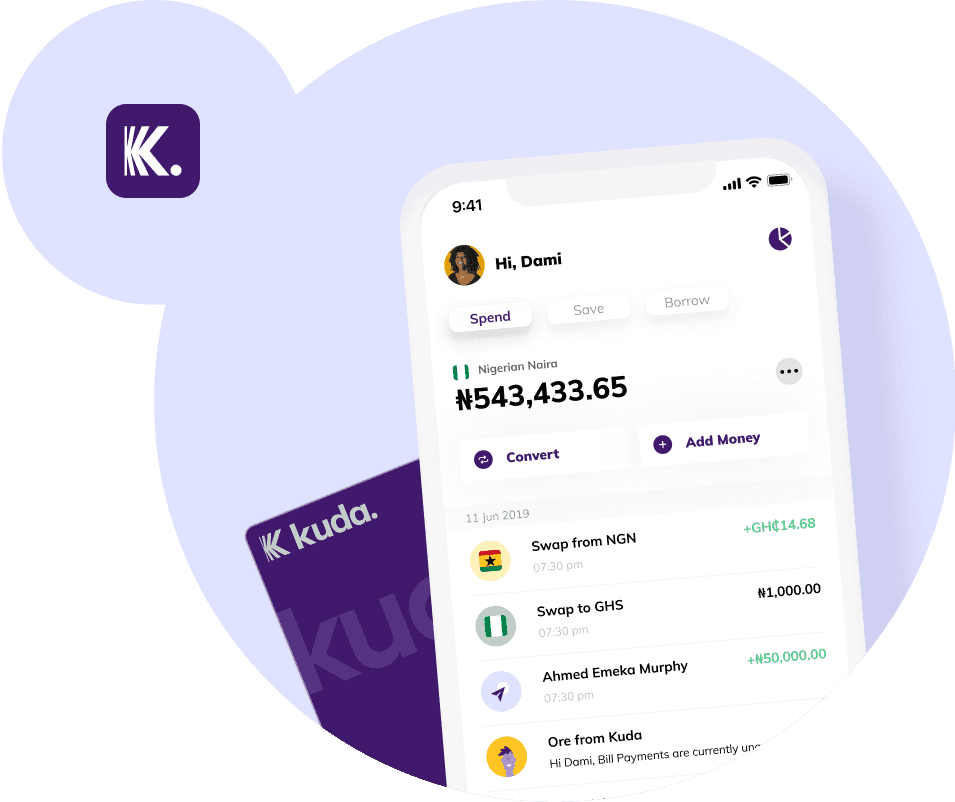

3. Kuda Bank

Kuda Bank is a digital-only bank that integrates saving features into its banking services, offering a seamless saving experience.

Features:

- No Maintenance Fees: Enjoy free banking services to save more.

- Spend+Save: Automatically save a percentage of every transaction.

- Fixed Savings: Lock funds for a set period to earn higher interest rates.

- Budgeting Tools: Use budgeting tools to manage your finances better.

- Instant Loans: Access quick loans with flexible repayment options.

4. Carbon

Carbon, formerly known as Paylater, is a fintech app that offers saving and investment options in addition to its loan services.

Features:

- High-Interest Savings: Earn competitive interest rates on your savings.

- Automated Savings: Set up automated savings for convenience.

- Loan Services: Access quick loans with flexible terms.

- Bill Payments: Pay bills directly from the app.

- Investment Opportunities: Invest in various financial instruments.

Download for Android Here

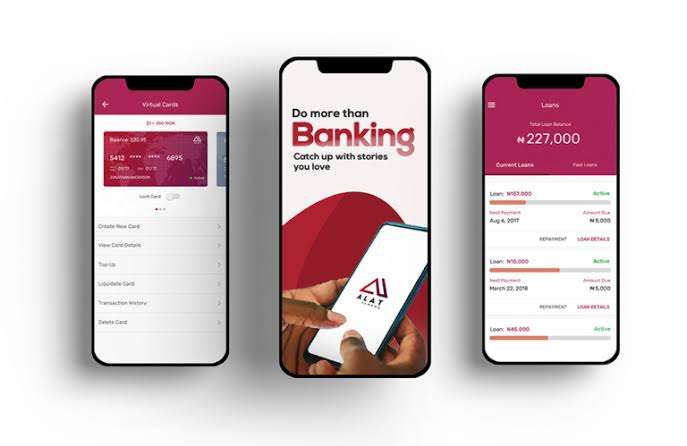

5. ALAT by Wema

ALAT is Nigeria’s first fully digital bank, developed by Wema Bank. It offers innovative saving features tailored to modern users.

Features:

- Goal-Based Savings: Set and achieve various savings goals.

- Automated Savings: Automatic savings deductions from your account.

- Virtual Dollar Card: Get a virtual card for international transactions.

- Bill Payments: Pay various bills directly from the app.

- Instant Loans: Access quick loans with minimal paperwork.

6. SumoTrust

SumoTrust is a savings and investment platform designed to help users build wealth over time.

Features:

- Automated Savings: Set automatic savings plans to save regularly.

- Fixed Savings: Lock funds to earn higher interest rates.

- Goal-Oriented Savings: Create savings goals and track progress.

- Sumo Investments: Access to investment opportunities with attractive returns.

- Educational Savings: Save specifically for educational needs.

7. Eyowo

Eyowo offers a range of financial services, including savings, to help users manage their money better.

Features:

- Automated Savings: Set up automatic savings plans.

- Free Transfers: Transfer money to other Eyowo users for free.

- Bill Payments: Pay bills directly from the app.

- Virtual Cards: Create virtual cards for online transactions.

- Interest on Savings: Earn interest on your savings.

Download for Android Here

8. Kolopay

Kolopay is designed to help users save for specific goals, making the saving process more targeted and efficient.

Features:

- Goal-Based Savings: Save for specific goals such as vacations, weddings, or gadgets.

- Automated Savings: Set up automatic savings to meet your goals.

- Flexible Savings Plans: Choose from various savings plans to suit your needs.

- Interest on Savings: Earn interest on your savings.

- Expense Tracker: Track your expenses to manage your finances better.

9. Awabah

Awabah focuses on providing micro-pension services to informal sector workers, by helping them save for retirement.

Features:

- Micro-Pension Plans: Save for retirement with flexible micro-pension plans.

- Automated Savings: Set up automatic savings for consistent contributions.

- Interest on Savings: Earn interest on your pension savings.

- Financial Education: Access resources to improve financial literacy.

- Easy Withdrawals: Withdraw savings easily when needed.

10. Thrive Agric

Thrive Agric allows users to invest in agricultural projects, combining savings with investment opportunities.

Features:

- Investment in Agriculture: Invest in various agricultural projects.

- Automated Savings: Set up automated savings to fund your investments.

- High Returns: Earn attractive returns on your investments.

- Impact Investing: Support the agricultural sector and rural farmers.

- Easy Withdrawals: Withdraw your earnings easily.

In Conclusion

While some people still prefer saving with old traditional ways like Daily Collectors a.k.a Ajọ, these daily money savings apps are revolutionizing how Nigerians save money.

These apps offer a range of features that make saving convenient, automated, and rewarding. By choosing the right Savings App, you can enhance your financial health and achieve your savings goals more effectively.

FAQ

What is a daily money savings app?

A daily money savings app is a mobile application designed to help users save money regularly. These apps often offer automated saving plans, goal-based savings, and other financial tools to encourage consistent saving habits.

Why should I use a daily money savings app?

Using a daily money savings app helps instill financial discipline, automate savings, track goals, and often earn higher interest rates compared to traditional savings accounts. Apps like Piggyvest, Cowrywise, and Kuda Bank offer features that simplify the saving process.

Which is the best daily money savings app in Nigeria?

Piggyvest is considered one of the best daily money savings apps in Nigeria due to its comprehensive features such as automated savings, Safelock, target savings, Flex Dollar, and investment opportunities.

Can I earn interest on my savings with these apps?

Yes, most daily money savings apps like Piggyvest, Cowrywise, and Carbon offer interest on savings, often at competitive rates.

Are these apps safe to use?

Yes, the daily money savings apps mentioned in this article are regulated by relevant financial authorities in Nigeria and use advanced security measures to protect users’ funds and personal information.

How do automated savings plans work?

Automated savings plans allow users to set up regular, automatic transfers of a specific amount from their bank account to their savings account within the app. This ensures consistent savings without needing to manually transfer money each time.

Can I save for specific goals with these apps?

Yes, many daily money savings apps like Kolopay, ALAT by Wema, and SumoTrust offer goal-based savings, allowing users to set and track savings for specific purposes such as vacations, education, or emergencies.

Do these apps offer investment opportunities?

Yes, apps like Piggyvest, Cowrywise, Carbon, and Thrive Agric offer investment opportunities, enabling users to grow their savings by investing in various financial instruments or agricultural projects.

What are the benefits of using a digital-only bank like Kuda Bank or ALAT?

Digital-only banks like Kuda Bank and ALAT offer the convenience of managing your finances entirely online without the need for physical branches. They often provide lower fees, better interest rates, and innovative features like automated savings and virtual cards.

How do I choose the best daily money savings app for me?

Consider your financial goals, the features offered by each app, interest rates, fees, and user reviews. Choose an app that aligns with your saving and investment needs, offers robust security, and provides excellent customer support.